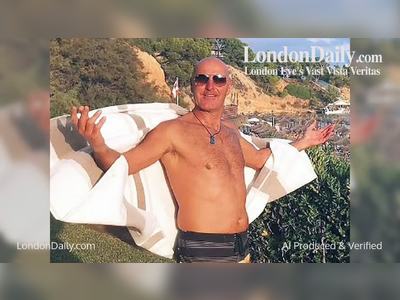

Tech Investor Orlando Bravo Warns AI Valuations Have Entered Bubble Territory

Thoma Bravo co-founder cautions that sky-high expectations are misaligned with fundamentals despite strong corporate backing

Renowned private equity investor Orlando Bravo has publicly warned that valuations in the artificial intelligence sector are entering bubble territory, drawing comparisons to the dot-com era.

Speaking on CNBC’s “Squawk on the Street,” he cautioned that the market is overvaluing early revenue streams and that even when product and market align, scaling to justify lofty multiples is a “tall order”.

Bravo rejected the plausibility of pricing a company generating USD 50 million in recurring annual revenue at USD 10 billion, pointing out that the business would have to yield roughly USD 1 billion in free cash flow to double an investor’s money.

He emphasized that this challenge holds “even if the product is right, even if the market’s right”.

Still, Bravo acknowledged an important distinction between the AI wave now and the tech bubble of the late 1990s: today’s environment features large corporates with strong balance sheets backing AI firms, providing capital support not seen in earlier speculative cycles.

His firm, Thoma Bravo, manages over USD 181 billion and maintains a major focus on enterprise software and cybersecurity, areas where AI enhancements can unlock new value.

Bravo expressed optimism that generative AI and agentic solutions will act as accelerants for software adoption.

He said, “With AI, you have so much more to sell.

an easier way for the customer to engage with your product.

That is a big, big new exciting tailwind for the industry”.

While many industry voices echo Bravo’s caution, capital has continued to flood the AI space.

Earlier this week, a Reuters-reported surge in Oracle stock added fresh fuel to bubble debates, as the company’s forward price-to-earnings ratio reached levels rarely seen since the dot-com peak.

At the same time, broader warnings are emerging: GIC executives warned of AI startups with “modest revenues” being valued at unsustainable multiples, and analysts flag a speculative hype layer masking deeper fundamentals.

The tension between innovation optimism and valuation discipline thus crystallizes in Bravo’s comments—a call for caution delivered from within the very tech-investing establishment.

Speaking on CNBC’s “Squawk on the Street,” he cautioned that the market is overvaluing early revenue streams and that even when product and market align, scaling to justify lofty multiples is a “tall order”.

Bravo rejected the plausibility of pricing a company generating USD 50 million in recurring annual revenue at USD 10 billion, pointing out that the business would have to yield roughly USD 1 billion in free cash flow to double an investor’s money.

He emphasized that this challenge holds “even if the product is right, even if the market’s right”.

Still, Bravo acknowledged an important distinction between the AI wave now and the tech bubble of the late 1990s: today’s environment features large corporates with strong balance sheets backing AI firms, providing capital support not seen in earlier speculative cycles.

His firm, Thoma Bravo, manages over USD 181 billion and maintains a major focus on enterprise software and cybersecurity, areas where AI enhancements can unlock new value.

Bravo expressed optimism that generative AI and agentic solutions will act as accelerants for software adoption.

He said, “With AI, you have so much more to sell.

an easier way for the customer to engage with your product.

That is a big, big new exciting tailwind for the industry”.

While many industry voices echo Bravo’s caution, capital has continued to flood the AI space.

Earlier this week, a Reuters-reported surge in Oracle stock added fresh fuel to bubble debates, as the company’s forward price-to-earnings ratio reached levels rarely seen since the dot-com peak.

At the same time, broader warnings are emerging: GIC executives warned of AI startups with “modest revenues” being valued at unsustainable multiples, and analysts flag a speculative hype layer masking deeper fundamentals.

The tension between innovation optimism and valuation discipline thus crystallizes in Bravo’s comments—a call for caution delivered from within the very tech-investing establishment.