National insurance rise forces UK employers to shoulder £9bn tax burden

Britain’s employers are being forced to shoulder a £9bn tax rise after the government pushed ahead with raising national insurance on Wednesday despite stiff opposition.

Company bosses said the 1.25-percentage-point rise in national insurance contributions (NICs), which is paid by workers and their employers, would add to already severe pressure from runaway inflation and soaring business costs this year linked to Covid, Brexit and Russia’s war in Ukraine.

“[The] national insurance rise piles another cost pressure on top of firms at a time when they can ill afford to bear it,” said Shevaun Haviland, the director general of the British Chambers of Commerce.

“Members are telling us that energy bills are soaring while the price of raw materials are reaching levels many have never encountered before. This comes alongside vastly increased shipping costs and a squeezed labour market.”

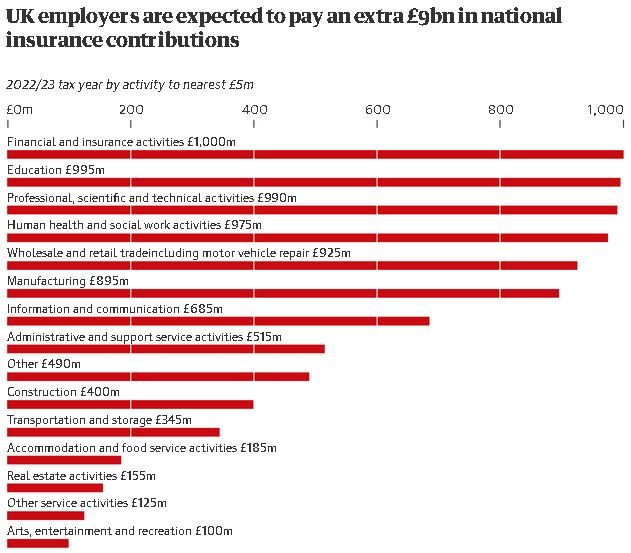

According to Treasury figures released in response to a parliamentary question from Labour, the portion paid by employers is to raise £8.8bn for the exchequer in the current financial year.

The brunt of the rise will be borne by key sectors including manufacturing, which is facing extra taxes worth £900m. Employers in the health and social care sector will be taxed £1bn extra, while those in the wholesale and retail trade will face a similar increase and the construction industry will be landed with a bill worth £400m.

Jonathan Reynolds, the shadow business secretary, said the figures showed the government was not on the side of employers. “The Conservatives’ decision to hike taxes during a cost of living crisis will make things even harder for businesses and families,” he said.

Reynolds said Labour would instead have launched a one-off windfall tax on profits made by oil and gas producers amid the surge in energy prices, which would be used to help small firms with tax cuts and support for energy intensive industries such as ceramics.

With inflation at the highest rate since at least the early 1990s, the government has faced heavy criticism from across the political spectrum for pushing ahead with the manifesto-busting NICs rise

Designed to raise billions of pounds to fund health and social care, the move has prompted questions about the timing, amid Britain’s worsening cost of living crisis, with critics arguing that other options could have been pursued to raise the money.

Defending the plan on Wednesday, Boris Johnson said he had “absolutely no problem” with the increase because it was “unquestionably the right thing for our country” as the health service faced growing demand and grappled with a backlog built up during the pandemic.

However, employers groups said it would inflict pain for businesses struggling to recover from the Covid shock to the economy.

Martin McTague, the national chair of the Federation of Small Businesses, said it was a “jobs tax hike” that would hurt workers and employers. “The small business tax burden is now at its greatest since the 1950s – a development which couldn’t have come at a worse time, with spiralling energy costs, input cost inflation, supply chain disruption and Covid-related staff absence all taking their toll,” he said.

Research from the manufacturers’ trade group Make UK shows as many as 60% of industrial firms believe the rise will have a moderate or significant impact on their recruitment plans, while almost three-quarters say it will add to inflationary pressures that will be passed on to consumers.

“The NICs increase is just one of many significant costs facing UK manufacturers and there will be a big question as to whether the UK is a competitive place to do business right now,” a spokesperson for the group said.

The Treasury said it was supporting workers and businesses with rising costs, including a tax cut worth £1,000 for half a million small firms by increasing the employment allowance – a tax break on wage bills – starting from Wednesday.

The chancellor, Rishi Sunak, used his spring statement last month to offset some of the impact of rising inflation, including an increase in the threshold at which workers begin to pay national insurance from £9,880 to £12,570 that comes into effect from July.

On top of a package of energy support including a council tax rebate and loan scheme announced in February, Sunak announced a 5p cut to fuel duty rates, a £500m increase in a household support fund and pledged a 1p cut in the basic rate of income tax in two years’ time.

However, only £1 in every £3 of the measures announced by the chancellor will go to the poorest half of people in Britain, according to the Resolution Foundation. The Institute for Fiscal Studies estimates the national insurance rise will rake in about £17.2bn in total for the exchequer from workers and employers, far more than the £6.3bn cut for workers benefiting from the threshold change.

A government spokesperson said it was supporting employers and workers. “No government can control the global factors pushing up prices, but we will act where we can to support businesses,” they added.