Exclusive: UK debt agency treads careful path to sell near-record volume of bonds

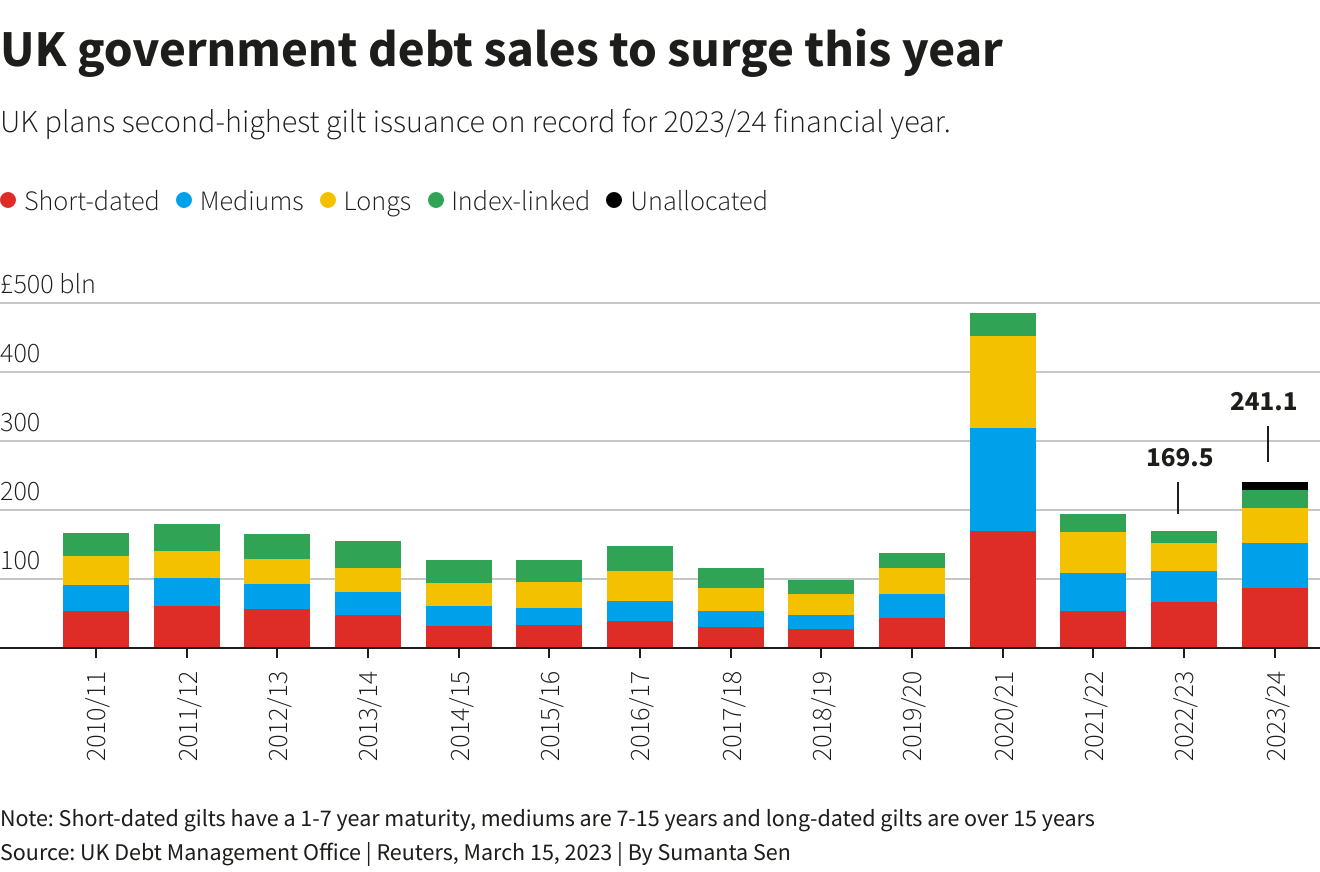

After finance minister Jeremy Hunt announced his budget plans earlier on Wednesday, the DMO said it would need to sell 241.1 billion pounds ($291 billion) of government bonds in the 2023/24 financial year - the highest on record apart from 485.8 billion pounds sold in 2020/21.

In some ways, the challenge now is even tougher. The Bank of England is no longer a buyer in the market, and instead is reducing its own gilt holdings by 80 billion pounds a year.

And recent days have seen some of the biggest daily price swings in decades in fixed income markets, as investors reset their interest rate expectations following the collapse of Silicon Valley Bank and concerns about Credit Suisse.

"Global financial markets are pretty stressed and volatile. Some of the movements that have occurred over the last week in fixed income markets have been huge," DMO chief executive Robert Stheeman told Reuters.

Britain experienced its own bond market turmoil in late September and October, when an adverse reaction to then Prime Minister Liz Truss's plans for unfunded tax cuts forced the Bank of England to intervene.

"The big difference now is that these movements are not UK-driven," Stheeman said.

Britain has seen strong investor demand at most of its bond auctions, although a handful of auctions have had to accept slightly low bids to sell the full volume of debt on offer.

A VERY LARGE AMOUNT OF MONEY

The DMO now wants to ensure that its primary dealers - a group of 17 major financial institutions which have the right to take part in British government debt auctions - are not overburdened by the amount of debt they need to bid for and sell on to customers.

"Behind the scenes, we're very focused on the duration risk and spreading that out, and make sure that supply doesn't unnecessarily weigh on the balance sheet capacity and the intermediation capacity of our primary dealers," Stheeman said.

"We do what we can, while obviously needing to raise a very large amount of money."

In practice, that can mean a skew towards short-dated bonds with a maturity of under seven years, although British government debt continues to have the longest maturity of any major economy.

"We can issue larger cash amounts in, for instance, a short-dated auction than in a long- or index-linked auction," Stheeman said.

Over the coming year, the DMO aims to sell 86.7 billion pounds of short-dated bonds, 65.3 billion pounds of medium-dated, 50.1 billion pounds of long-dated gilts and 26.2 billion pounds of inflation-linked debt.

The medium- and long-dated debt includes 10 billion pounds of 'green' bonds - a volume that is capped by the requirement for the government to designate investment projects which meet certain environmental criteria.

The DMO has also had to develop a working relationship with the Bank of England, which now has its own separate bond auction programme. The two organisations have agreed not to hold auctions on the same day as each other, but there can now be as many as four separate British government bond sales in a week.

"This is a process that's been going on now for a couple of months, and which so far has worked quite well," Stheeman said. "It does mean of course that the calendar looks very crowded from the perspective of the street."

($1 = 0.8295 pounds)