Bitcoin faces biggest one-day slump since last year as China announces curbs

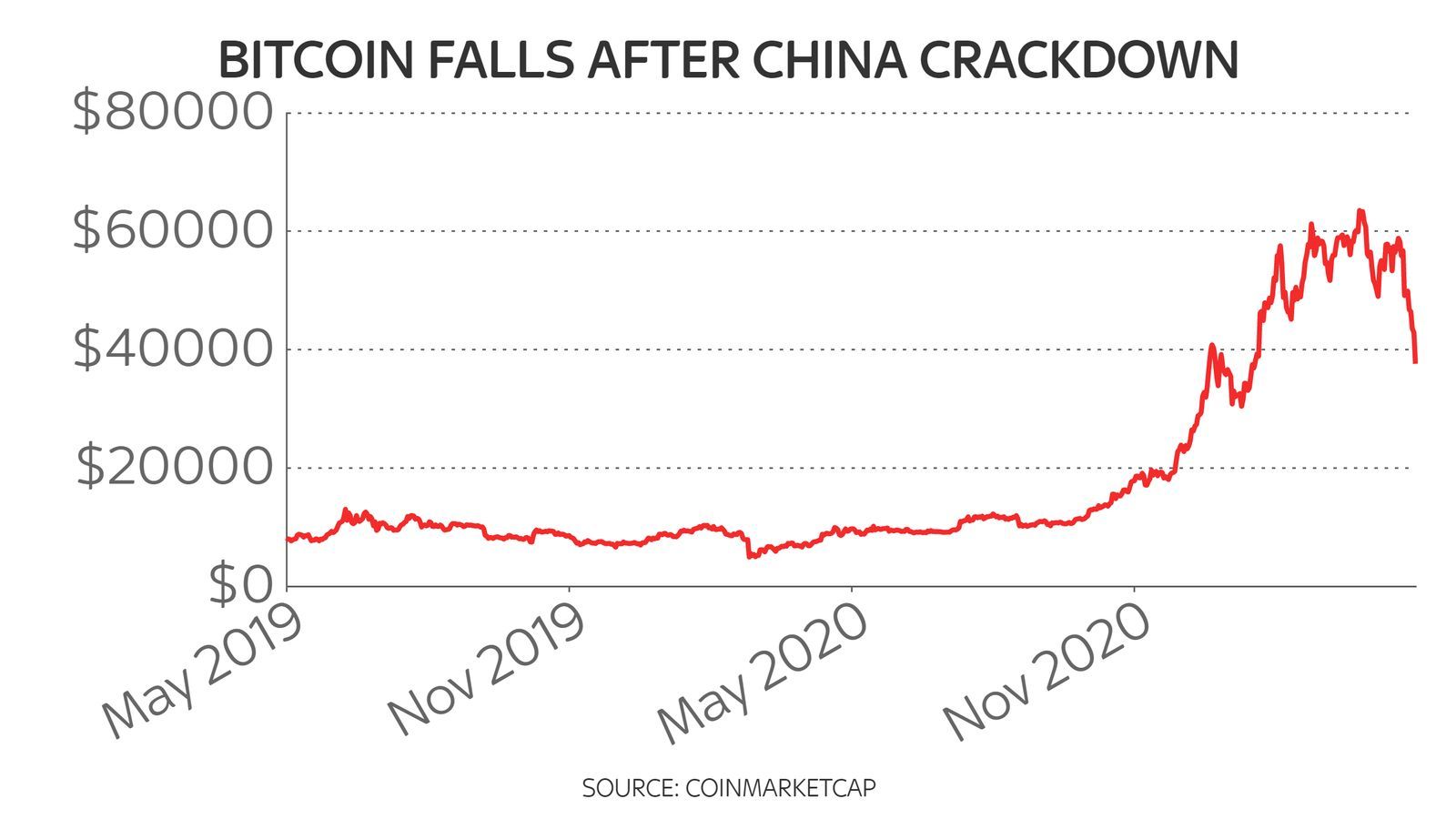

Bitcoin's price has fallen sharply after China announced curbs on cryptocurrency transactions.

The cryptocurrency dropped by more than 20% to extend a sharp downturn over the past month.

It dipped below $40,000 (£28,241) and hit its lowest level for more than three months on Wednesday afternoon, briefly even falling further to around $30,000 (£21,180).

Bitcoin rose sharply earlier this year

Bitcoin rose sharply earlier this year

Later it partly recovered but was still trading 10% lower on the day at just above $38,000.

The slump was on course to be the biggest one-day fall since March last year and was mirrored by other cryptocurrencies such as ethereum and dogecoin.

At one point, nearly $1trn was wiped off Bitcoin's total market capitalisation.

Bitcoin had risen sharply earlier in the year and hit a high of just under $65,000 (£45,891) in April but has since come under pressure after a series of tweets from Tesla boss Elon Musk.

The electric car maker earlier this year revealed a major investment in the cryptocurrency and said it would start accepting it as payment.

But last week it reversed that position because of the environmental impact of using Bitcoin, which is "mined" using energy-intensive computer processes.

Elon Musk's tweets about Bitcoin have impacted the market

Elon Musk's tweets about Bitcoin have impacted the market

Now, China has announced a ban on financial institutions and payment companies from providing services related to cryptocurrencies - intensifying the selling pressure. It also warned investors against speculative crypto trading.

Meanwhile, analysts at JP Morgan said some institutional investors were exiting Bitcoin for gold - a more traditional store of value when other asset classes are volatile.

It comes at a time when the wider market is gripped by worries about inflation and whether that will mean interest rates in the US turning higher sooner than previously thought.

Those fears helped send London's FTSE 100 and New York's Dow Jones more than 1% lower on Wednesday, following previous volatile trading last week.

Comments