UK house prices fall for longest period since 2009 - Nationwide

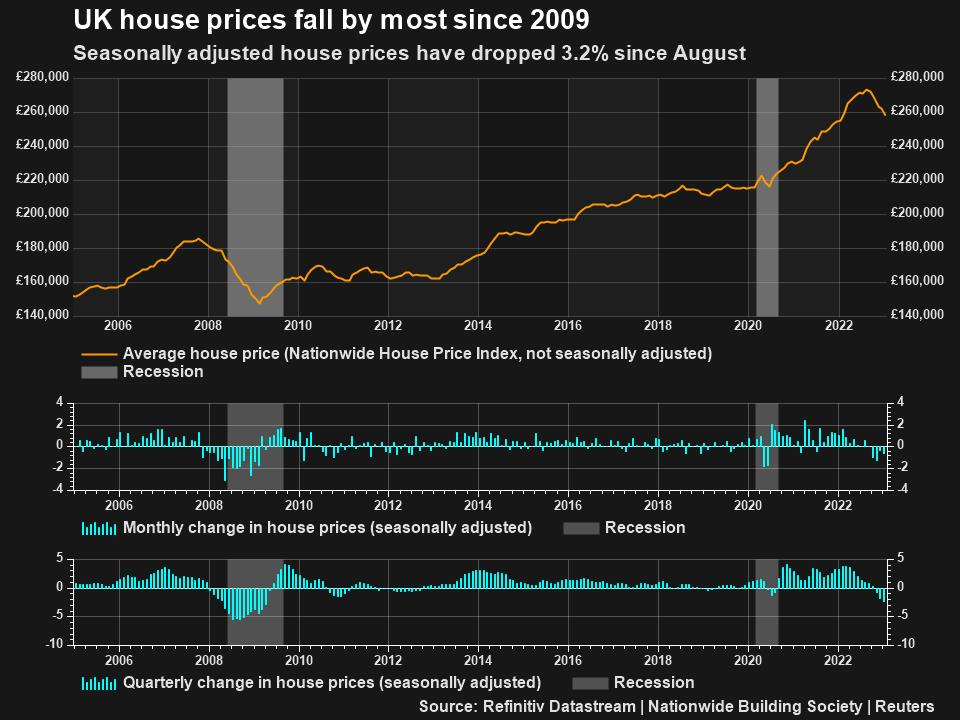

January's decline in house prices was the fourth drop in a row - the longest unbroken run of declines since 2009 - and the fall was twice the size expected in a Reuters poll of economists, adding to signs that the market is slowing rapidly.

Prices in the three months to January were down 2.3% compared with the previous three months, the largest such drop since the three months to April 2009.

Interest rates have risen sharply since December 2021 and there was major disruption to the mortgage market in late September and October following former prime minister Liz Truss's "mini budget", which sent market interest rates soaring.

"It will be hard for the market to regain much momentum in the near term as economic headwinds are set to remain strong, with real earnings likely to fall further and the labour market widely projected to weaken as the economy shrinks," Nationwide chief economist Robert Gardner said.

Nationwide forecast in December that house prices would fall 5% in 2023.

House prices in January were 1.1% higher than a year earlier, Nationwide said, the smallest year-on-year increase since June 2020 and down from a 2.8% increase in December. Economists polled by Reuters had expected a rise of 1.9%.

Seasonally adjusted house prices have dropped 3.2% since August, according to Nationwide Building Society

Seasonally adjusted house prices have dropped 3.2% since August, according to Nationwide Building Society

However, the boom has now gone into reverse, accelerated by disruption to lending since the mini-budget.

The Bank of England reported on Tuesday that the number of mortgages approved in December fell to its lowest since the global financial crisis, excluding the very start of the COVID-19 pandemic when there were strict lockdown restrictions.

Gardner said this fall reflected a drop in mortgage applications after the mini-budget, and that it was too soon to know if the volume of house purchases would recover.

While lenders are now more willing to offer mortgages than just after the mini-budget, the BoE has steadily raised interest rates, and is expected to increase its main rate by half a percentage point to 4% on Thursday, the highest since 2008.