UK exports to EU fell by £20bn last year, new ONS data shows

UK exports of goods to the EU have fallen by £20bn compared with the last period of stable trade with Europe, according to official figures marking the first full year since Brexit.

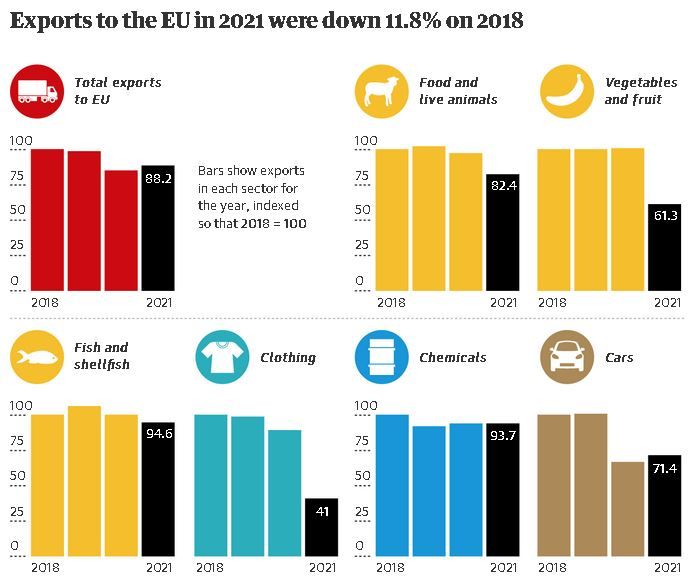

Numbers released on Friday by the Office for National Statistics (ONS) showed that the combined impact of the pandemic and Britain’s exit from the single market caused a 12% fall in exports between January and December last year compared with 2018.

Highlighting the disproportionate impact of leaving the EU, exports to the rest of the world excluding the 27-nation bloc dropped by a much smaller £10bn, or about 6% compared with 2018 levels.

The ONS compared trade performance against figures from three years ago because that was the last year before distortions caused by firms stockpiling ahead of Brexit deadlines and the spread of Covid-19.

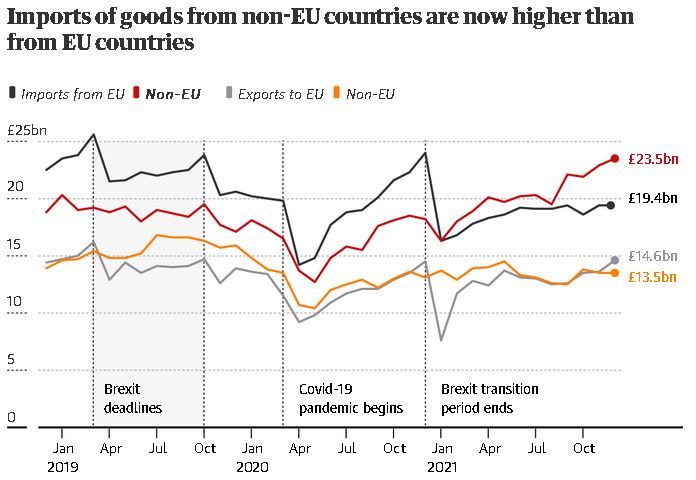

Despite the disruption, the EU remains the UK’s largest trading partner. However, for the first time since comparable records began in 1997, the UK now spends more importing goods from the rest of the world than it does from the EU.

UK goods imported from the EU were down almost 17%, or about £45bn, compared with 2018. In comparison, imports from the rest of the world increased by almost 13%, or about £28bn.

With the EU accounting for just over half of UK exports worldwide, economists said Brexit was serving as an extra headwind for Britain, compounding the disruption from Covid being felt across advanced economies. “UK exporters are continuing to lose market share,” said Gabriella Dickens, an economist at the consultancy Pantheon Macroeconomics.

Although trade levels have picked up in recent months, data from the Netherlands Bureau for Economic Policy Analysis show that real goods exports from advanced economies were 3.8% above their 2018 average in November, outpacing the UK.

The hardest-hit commodities recorded dramatic falls. Outbound shipments of clothing and footwear to the EU were both down by almost 60% compared with 2018. Food and live animal exports – for which more stringent border checks are required – were down almost 18%, while vegetable exports dropped by almost 40%. Shipments of cars to the EU, heavily disrupted by global supply chain issues and Covid, were down by a quarter.

Guillermo Larbalestier, a trade economist at the University of Sussex, said the drop in vegetable exports was probably linked to a fall in the number of seasonal workers available to pick and process crops, more burdensome paperwork and the difficulty in exporting perishable goods in the face of extended delays at the border.

Clothing exports have been affected because a high proportion of garments sold by UK retailers are made in Asia or the US, making them ineligible for the tariffs negotiated in the post-Brexit trade deal.

However, the latest figures do suggest a recovery from the worst of the Brexit damage seen in January 2021, just after Britain’s departure, when exports to the EU plunged by 40%.

According to the latest figures, UK exports to the EU were about £200m higher in December 2021 than the same month in 2018, but much of this was driven by an increase in wholesale gas prices on international energy markets.

Business leaders have warned that border restrictions and reams of red tape have pushed up costs and added to delivery times, permanently undermining the competitiveness of UK goods on the continent.

Sixty-seven percent of firms experienced a challenge when exporting and 72% when importing in the last month, according to ONS surveys.

“There is a lot more friction on trade, which you would expect to have a more medium-to long-term impact,” said Grant Fitzner, chief economist at the ONS.

Gareth Thomas, the shadow international trade minister, said the government had exaggerated the benefits of trade deals with countries outside the EU that have yet to be negotiated. “Ministers are not doing enough to support our exporters in markets outside Europe, while the deal they negotiated with the EU has led to long lorry queues into Dover, a big increase in red tape and a significant decline in trade,” he said.

A UK government spokesperson said: “UK goods exports to EU nations were 4% higher last year compared with 2020. However, as the ONS itself recognises, the impact of the Covid-19 pandemic, global recession and supply chain disruption, have caused higher levels of volatility in recent statistics. It is therefore still too early to draw any firm conclusions on the long-term impacts of our new trading relationship with the EU.

“We are continuing to ensure that businesses get the support they need to trade effectively with Europe.”