Pound sinks as investors question huge tax cuts

UK stocks also dropped after chancellor Kwasi Kwarteng outlined a series of tax cuts and economic measures in a massive shake-up of the country's finances.

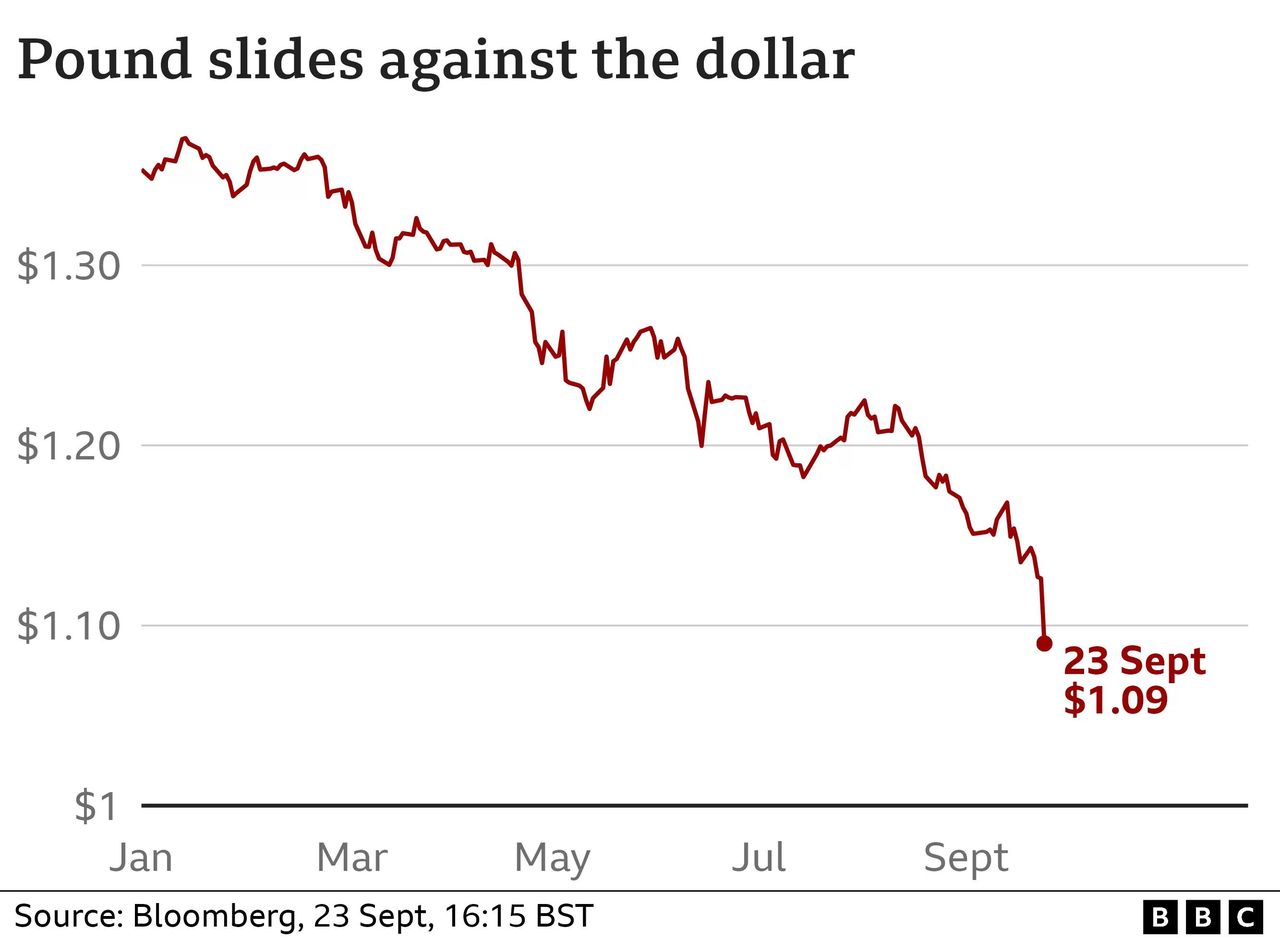

The pound fell more than 3% against the dollar, dropping below $1.09.

Sterling has fallen recently over worries about the economy and partly due to a stronger US dollar.

The pound also fell more than 1% against the euro on Friday, dropping to €1.12.

Mr Kwarteng refused to comment on the dropping value of the currency, saying he "doesn't comment on market movements".

The cost of government borrowing soared following the announcement, rising by near-record amounts, as investors did the sums over the new strategy.

According to Bloomberg data, analysts expect UK interest rates to hit 5.2% in August 2023, with expectations rising that there could be a one percentage point interest rate hike at the Bank of England's next meeting in November.

The Institute for Fiscal Studies (IFS), an economic think tank, said the market reaction was "worrying" as the government's new strategy relied on investors being willing to lend more to the UK.

"The plan seems to be to borrow large sums at increasingly expensive rates, put government debt on an unsustainable rising path, and hope that we get better growth," said IFS director Paul Johnson.

Mr Johnson said the new strategy would inject demand into a high inflation economy, risking further price rises. At the same time the Bank of England was pulling in the opposite direction, and was likely to raise interest rates even further in response to the £45bn tax reduction.

The Bank of England needs to make an emergency, unscheduled rate hike as soon as next week "to regain credibility with the market", said Deutsche Bank strategist George Saravelos.

He said that move would also send a strong signal that the bank is "willing to do 'whatever it takes' to bring inflation down quickly".

Former US Treasury secretary Larry Summers warned the pound could fall below the dollar due to the huge spending commitments outlined by Mr Kwarteng.

"It makes me very sorry to say, but I think the UK is behaving a bit like an emerging market turning itself into a submerging market," Mr Summers told Bloomberg.

"Between Brexit, how far the Bank of England got behind the curve and now these fiscal policies, I think Britain will be remembered for having pursuing the worst macroeconomic policies of any major country in a long time."

Jane Foley, a currency strategist at Rabobank, said the sell-off of sterling showed investors have doubts about the government's plans.

"They're worried that some of these tax cuts that have been announced aren't going to be fully funded. That will result in a large amount of debt at a time when the Bank of England is going to be selling some of its holdings of UK government debt," she said.

"I think this government does need to provide a lot more reassurance that it does have fiscal sensibility in order. This is not the message that's come across this morning."

The UK's FTSE 100 index of major shares fell more than 2%, dropping to its lowest level for more than two months, reflecting concerns that the plan to stimulate growth might not pay off.

The plan also contributed to a sell-off in US markets, where the three main share indexes fell more than 2%.

"Ultimately, the growth dice have been rolled. But it is too early to know if the gamble will succeed and boost confidence enough to encourage businesses and people to spend and invest, stimulating the UK economy," said Karen Campbell-Williams, head of tax at Grant Thornton.

Thomas Pugh, economist at RSM UK said there was likely to be a boost to the economy of "roughly 1%" over the next year, reducing the risk of a longer recession, but that the longer term outlook was less positive.

"There was nothing in the budget that makes us more optimistic about the long-term growth trend of the economy. Trend growth is currently probably half of the 2.5% the Chancellor has set as his new target," he said.