Metal, money, mystery: How Sanjeev Gupta built his empire

The remote beauty of the mountains and Loch Linnhe, which runs like a dark carpet out to sea from the foot of the hills, makes this the last place you would expect to find a big industrial plant.

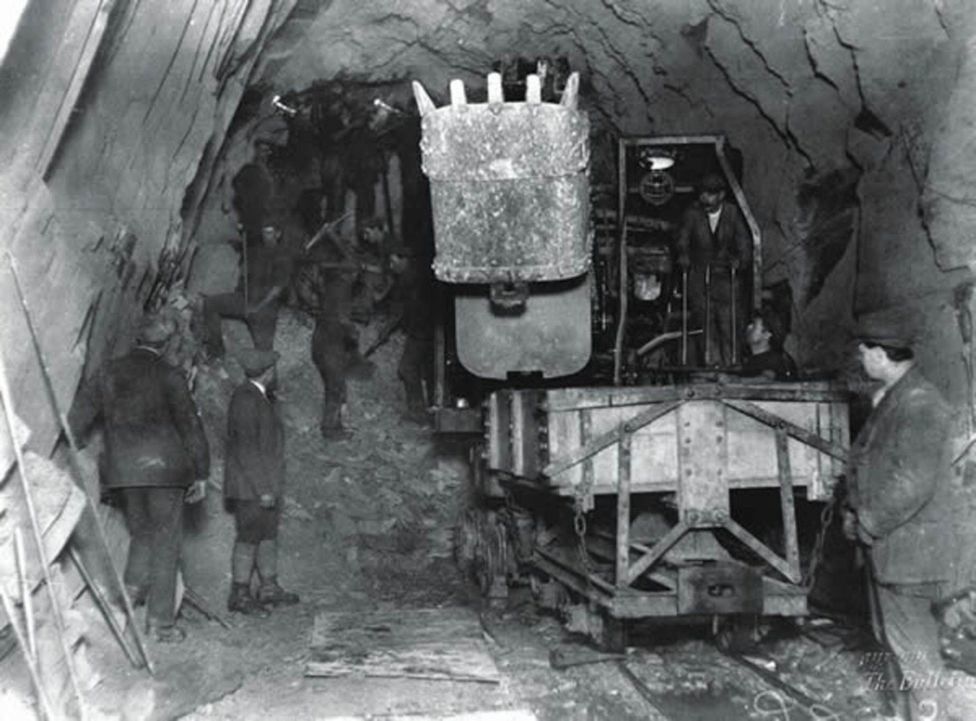

There is one, however - the last of its kind in the UK. The Lochaber smelter churns out 48,000 tonnes of aluminium a year, its turbines fed by water brought from the lochs above, in a tunnel that runs underground in a 12-mile curve around Ben Nevis itself.

Built in the 1930s, it was a prodigious feat of engineering. In the five years since he bought it, the owner of the smelter and the surrounding countryside, the metals tycoon Sanjeev Gupta, has managed a similar feat of engineering, this time financial.

He has raised more than £600m from a facility faced with closure, thanks in large part to financial support provided by the Scottish government. A spokesman for Mr Gupta wouldn't comment on what the money has been used for.

Plans for a big expansion at Fort William have so far come to nothing.

How Mr Gupta did it - the clever winnowing of value from an unattractive group of assets and the canny harvesting of financial support from politicians eager to maintain employment - follows a model he has used in building a business empire that now spans the world.

He and his family have bought steelworks, mines, power stations and smelters from Australia to the Czech Republic. Most faced an uncertain future and possible closure before his arrival.

Politicians have hailed him as a saviour, and he has made a popular and timely case for investment in more environmentally-friendly ways of making steel and aluminium.

Now he faces his own fight for survival. The money that fuelled his meteoric rise came from Greensill Capital, a supply-chain finance company that collapsed into administration in March. Mr Gupta is now battling to find new sources of finance, with some of his companies facing winding-up petitions from creditors.

Looming over all is a Serious Fraud Office (SFO) probe of his business empire, GFG Alliance, which will investigate alleged fraud, fraudulent trading and money laundering, with specific reference to the relationship with Greensill. GFG has said it will fully co-operate with the investigation.

In Scotland, a political backlash to the support granted by ministers is growing. If Mr Gupta fails in his refinancing attempt and his empire crumbles, there is the possibility of a hefty bill landing at the government's feet.

A pioneering project in the Highlands

Scotland was a world pioneer in making aluminium using hydroelectric power, with the first British Aluminium Company smelters commissioned in the final years of Queen Victoria's reign. The Fort William plant opened in 1929, and it is the last working aluminium smelter in the UK.

The smelter passed through several sets of owners until it was acquired by Rio Tinto, the mining giant, in 2007. Less than a decade later, Rio Tinto decided to get out.

It put the plant, the hydroelectric schemes and the associated land - a giant 114,000-acre estate, one of the biggest in Scotland - up for sale.

It was far from certain that the smelter would continue operating. It is tiny by world standards, and relies on imported bauxite - the raw ore from which aluminium is smelted - rather than having its own nearby source.

"There is only one smelter operating in the world which is smaller that I know of - one in Cameroon," Ami Shivkar, an aluminium specialist at the consultancy Wood Mackenzie tells the BBC.

"Lochaber makes nearly 50,000 tonnes a year - but many of competitors are making hundreds of thousands of tonnes. It is a drop in the ocean."

Many bidders were interested in the hydroelectric plants, few in the smelter. Brian King, who ran the plant for Rio Tinto and now does the same job as chairman of Alvance UK, the aluminium division of GFG Alliance, was intimately involved with the sale.

"There were only two bidders who had any real interest in the smelting operations. One of those was purely speculative, the other was GFG," says Mr Shivkar.

The Scottish government already had experience of dealing with Mr Gupta, having provided loans to help his purchase of two threatened steel plants, at Dalzell and Clydebridge.

In 2016, he emerged as the victor, paying Rio Tinto £330m.

How Sanjeev Gupta doubled his money

Almost immediately, work began on a financial restructuring to drive some value from the newly-acquired assets. Greensill Capital was drafted in to issue bonds - essentially loans - to City investors, which would be paid off by a slice of the future income from a second hydropower plant at Kinlochleven, which came with the estate.

The bonds were issued via a legal entity called Wickham, according to marketing documents seen by the BBC, and it is understood £229m was raised, most of which went straight to Rio Tinto as part of the purchase price.

Another, more complicated bond transaction - again arranged by Greensill, with the assistance of the Wall Street bank Morgan Stanley - required the explicit support of the Scottish government.

The marketing documents for Project Boots, also seen by the BBC, outline a convoluted structure. Gupta companies make an "irrevocable" commitment to pay investors in the bond issue a quarterly return.

That commitment is guaranteed by the Scottish government, which in return receives a fee and security over Gupta assets, chiefly the companies that own the hydroelectric power assets. The quarterly payments will continue, the documents make clear, even if the power station breaks down, or the smelter can't afford them.

Government support for a commercial bond issue is unusual - and the documents tell prospective investors that this is a "rare opportunity to invest in [sic] explicit and irrevocable Scottish government guaranteed fixed income asset".

"I have never seen a transaction like this," says Prof Florin Vasvari, chair of the accounting faculty at London Business School. "Bond issues are common, but normally there are just two parties - here there are several individual companies in the structure, and a sovereign guarantee.

"I am sure it would have been sought after because a guarantee like that is extremely rare."

Government support for private enterprise can fall foul of state aid rules, but the Lochaber deal was approved by ministers after an investigation by the accountancy firm EY judged that it met value for money and state aid tests.

Its report - Project Golf - has been made public, but nearly all of it is blacked out, on grounds of commercial sensitivity. The amount raised in the bond issue has not been publicly confirmed, but the Project Golf reports put its value at £259m.

That was not, though, the end of the fundraising. Last year, the power plant at Kinlochleven was sold to Equitix, an infrastructure investor, for what City sources confirm was about £150m.

Simec, the arm of the GFG Alliance that deals with power projects, also has another project on the go, with planning permission sought for a large wind farm at Glenshero in Inverness.

Local environmental groups, like the John Muir Trust, which looks after wild areas in Scotland including Ben Nevis, are staunchly opposed to the wind farm, saying its construction and scale would damage a precious landscape.

The plan has been rejected by Highland Council, and its fate will now be decided by the Scottish government.

There is widespread political support for the Scottish government's provision of financial assistance. Murdo Fraser, the Conservative MSP who was until recently shadow finance secretary, sat on the committee that approved it.

"There was a real concern that the smelter might close, so I understand the government going to lengths to secure its future. It is in an economically sensitive part of the country," he says.

The question now, says Mr Fraser, was whether Mr Gupta had made good on promises made in return for the financial support.

"He promised to make a new aluminium wheel factory that did not materialise, there were promises made about putting land into community ownership, and they did not materialise.

"And there are questions marks over whether the Scottish government was sufficiently cautious with taxpayer funds, given GFG was able to raise so much extra cash."

The Scottish government said in a statement that it had intervened to save a facility of "strategic importance" and that the same support had been offered to "any bidder with plans for long term industrial operations of the Lochaber businesses".

There had been no call on the guarantee to date, it said, and ministers had taken security, allowing them to claim certain assets if the GFG companies went bust.

GFG said the wheel plant scheme had to be abandoned because of the downturn in UK car manufacturing.

"If we had built it, it would now be standing idle," says Mr King, who stressed that GFG had kept the plant running for a number of years when aluminium prices were low and it was loss-making.

GFG is now working on plans for a plant to produce aluminium billet, shaped tubes and squares of metal that are used in extrusion manufacturing and command a higher price. It will cost about £90m and will employ about 60 more staff.

Were promises about the land honoured?

There is a wider unhappiness in Fort William with how Mr Gupta has managed the giant tracts of land acquired with the smelter.

The undertaking he gave to the Scottish government at the time of the deal - parts of which have again been seen by the BBC - made clear that he would hand back land to the community.

"We appreciate that community ownership is at the heart of Scottish government's community empowerment agenda," the document said. It added that Mr Gupta undertook to work with local groups to "to enter into community land transactions in relation to significant portions thereof".

John Hutchison, chairman of the East Lochaber and Laggan Community Trust, which is named in the undertaking, says no real attempt had been made to meet the commitment: "Five years on, here we are. We are still waiting."

GFG rejects the criticism, saying it has given over assets to local groups and works with charities.

"The East Lochaber and Laggan Community Trust have not presented us with a proposal we could consider," Julia Stoddart, chief operating officer of Jahama Highland Estates, the GFG company that manages the land, tells the BBC.

Uncertain future

The future of the smelter - and the other assets that go with it - are now inextricably linked to the wider fate of Mr Gupta's empire. His negotiations to find a new investor have been complicated by the SFO investigation.

White Oak Global Advisors, a Californian investment fund, has agreed to put some money into his Australian steelmaking operations, but similar talks for White Oak to invest in the UK have stalled.

City sources say that while many hedge funds and rivals are interested in buying assets or lending money, the situation is complicated by the outstanding loans to Greensill and its creditors, notably the Swiss bank Credit Suisse, which has already issued winding-up notices against two GFG companies.

Mr Gupta, has, however, been lucky in one respect - iron and aluminium prices are at a ten-year high, meaning most of his plants, including Fort William, will be making money.

The question now is whether he can find a way to keep his creditors - and the investigators - at bay.