Klarna Expands Buy Now, Pay Later Service to UK Google Pay Users

Swedish fintech integrates flexible payment options into Google Pay wallet, widening access for British shoppers

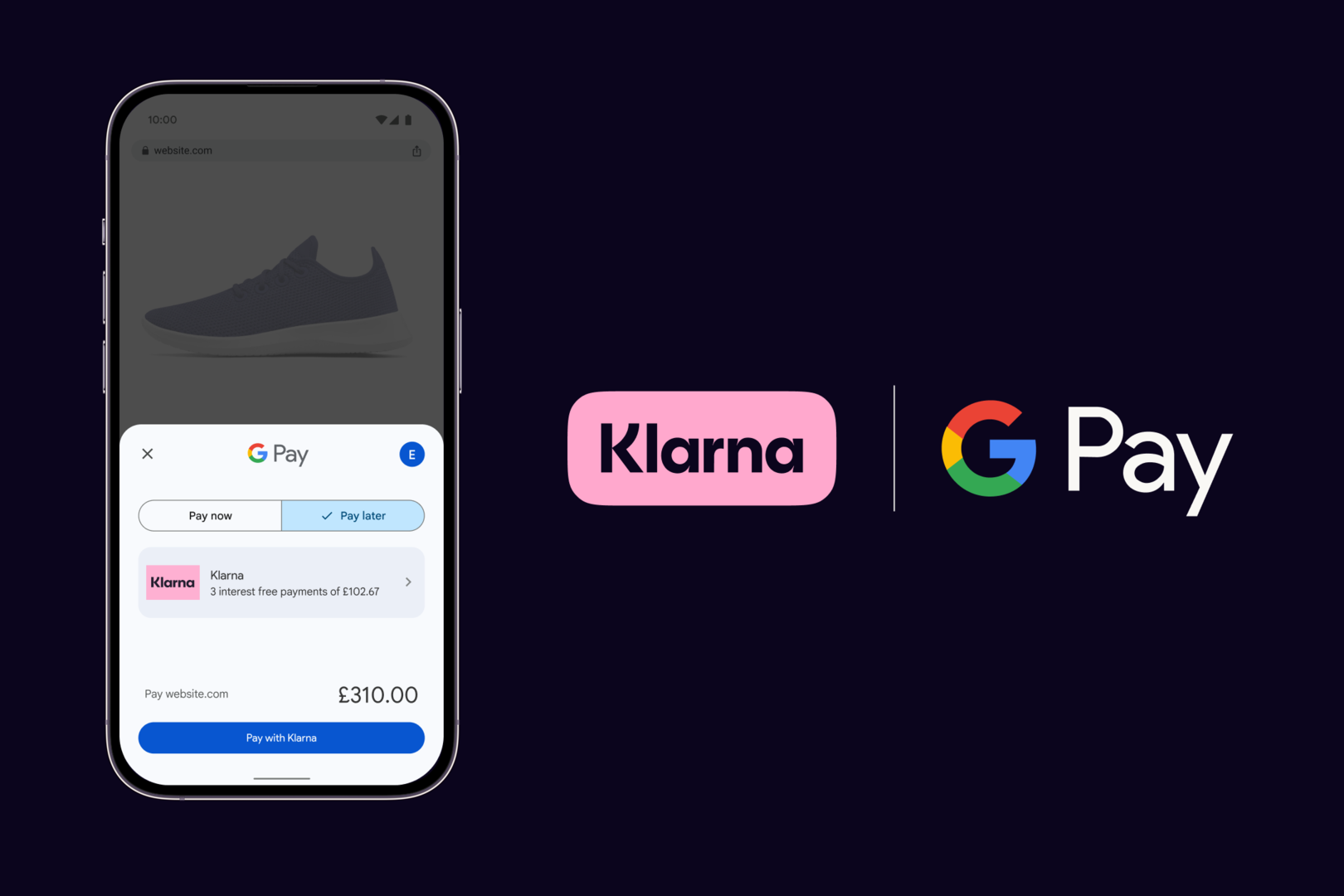

Klarna has expanded its footprint in the UK digital payments market by integrating its buy now, pay later services into Google Pay, enabling eligible users to select flexible payment options directly within the digital wallet.

The rollout allows UK consumers using Android devices to access Klarna’s instalment plans at participating online and in-app merchants where Google Pay is accepted.

Shoppers can choose to split purchases into interest-free payments or opt for longer-term financing, subject to approval and terms, without leaving the checkout environment.

The move reflects intensifying competition in the consumer payments space, as fintech providers seek to embed financing options seamlessly into widely used digital wallets.

By partnering with Google Pay, Klarna gains exposure to millions of UK users who rely on the platform for contactless payments and online transactions.

Klarna executives said the integration is designed to simplify the checkout experience while maintaining transparency over repayment schedules and fees.

The company emphasised that eligibility checks and consumer protections remain in place, in line with UK regulatory requirements governing buy now, pay later services.

The expansion comes amid closer scrutiny of the sector by UK regulators, who are advancing plans to bring buy now, pay later products more firmly within the consumer credit framework.

Industry analysts note that embedding instalment options within established wallet ecosystems may accelerate mainstream adoption while also placing greater responsibility on providers to ensure affordability assessments and clear disclosures.

Google Pay’s integration of Klarna follows similar partnerships globally, as technology platforms increasingly incorporate alternative financing tools alongside traditional debit and credit card payments.

The collaboration is expected to strengthen Klarna’s position in the UK market, where competition from other instalment providers and major card networks remains strong.

For consumers, the change means additional flexibility at checkout, though financial advisers continue to urge careful budgeting to avoid overextension when using deferred payment products.

The rollout allows UK consumers using Android devices to access Klarna’s instalment plans at participating online and in-app merchants where Google Pay is accepted.

Shoppers can choose to split purchases into interest-free payments or opt for longer-term financing, subject to approval and terms, without leaving the checkout environment.

The move reflects intensifying competition in the consumer payments space, as fintech providers seek to embed financing options seamlessly into widely used digital wallets.

By partnering with Google Pay, Klarna gains exposure to millions of UK users who rely on the platform for contactless payments and online transactions.

Klarna executives said the integration is designed to simplify the checkout experience while maintaining transparency over repayment schedules and fees.

The company emphasised that eligibility checks and consumer protections remain in place, in line with UK regulatory requirements governing buy now, pay later services.

The expansion comes amid closer scrutiny of the sector by UK regulators, who are advancing plans to bring buy now, pay later products more firmly within the consumer credit framework.

Industry analysts note that embedding instalment options within established wallet ecosystems may accelerate mainstream adoption while also placing greater responsibility on providers to ensure affordability assessments and clear disclosures.

Google Pay’s integration of Klarna follows similar partnerships globally, as technology platforms increasingly incorporate alternative financing tools alongside traditional debit and credit card payments.

The collaboration is expected to strengthen Klarna’s position in the UK market, where competition from other instalment providers and major card networks remains strong.

For consumers, the change means additional flexibility at checkout, though financial advisers continue to urge careful budgeting to avoid overextension when using deferred payment products.