How do I get the £400 energy grant and £650 cost-of-living payment?

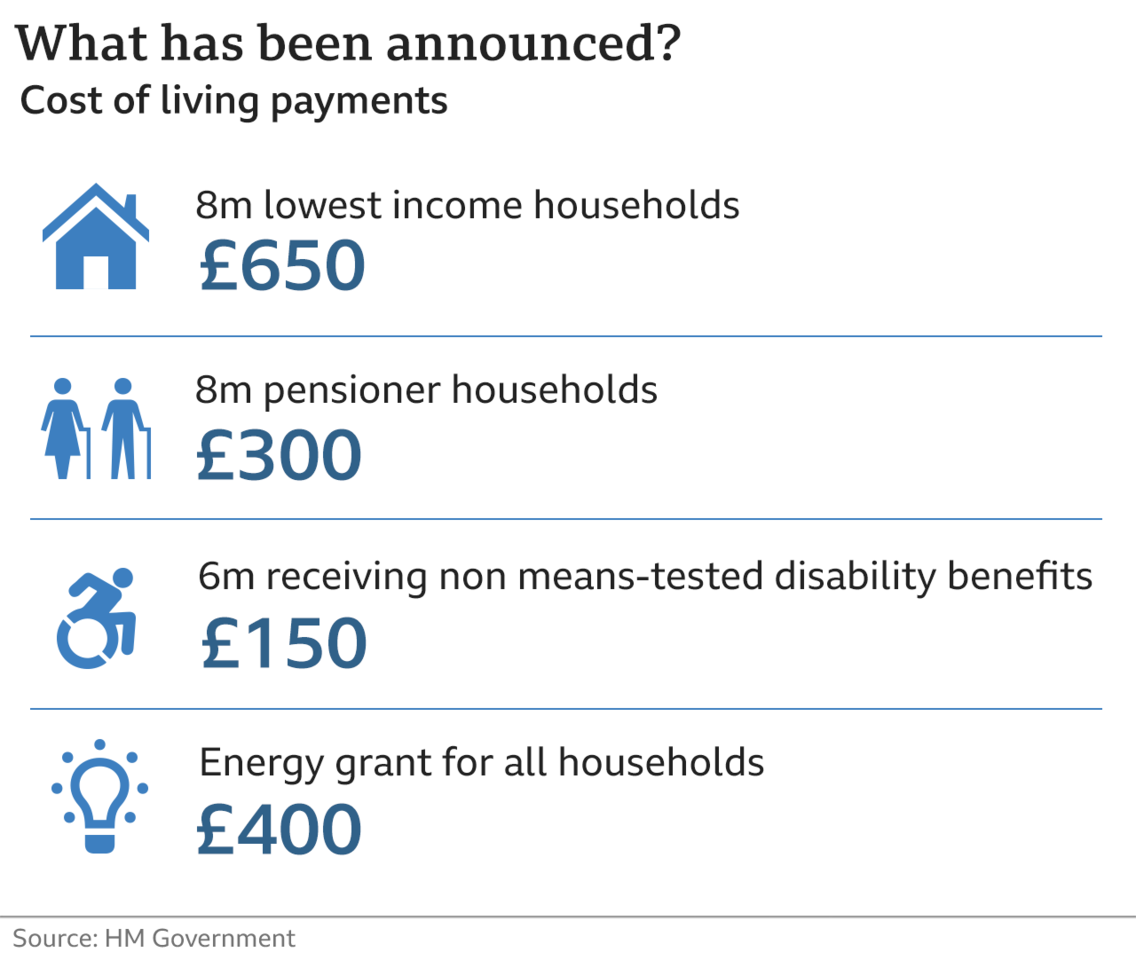

The measures are a mix of broad help and specific payments to those on lower incomes.

The first instalment of payments to those on benefits will be made from 14 July, the government has announced.

How will the £400 discount be paid out?

All UK households will get a grant which will reduce energy bills by £400 from October.

Previously, the chancellor had said £200 would be knocked off everyone's energy bills, but would have to be paid back in instalments over five years.

Now, the discount has been doubled and he has cancelled the requirement to repay.

In other words, from October, everyone's energy bill will be reduced by £400.

The discount will be made automatically by your energy supplier. There is no need to apply.

Over the course of six months from October, direct debit and credit customers will have the money credited to their account. Customers with pre-payment meters will have the money applied to their meter or paid via a voucher.

In technical terms. the grant will apply directly for households in England, Scotland, and Wales.

The equivalent funds should be given to Northern Ireland to distribute, although the way to do this has yet to be worked out.

What about the cost-of-living payments for people on benefits?

A £650 payment will be made to more than eight million low-income households who receive Universal Credit, income-based Jobseekers Allowance, income-related Employment and Support Allowance, Income Support, working tax credit, child tax credit and pension credit.

This will be an automatic payment into bank accounts.

It comes in two instalments - the first from 14 July and the second sometime in autumn. Payments for those on tax credits only will follow shortly afterwards.

The first payment will total £326 while the second will be £324.

The two cost-of-living payments will be paid automatically to anyone in England, Wales, Scotland and Northern Ireland receiving these benefits.

The government said the cash would be tax-free and not count towards someone's benefit cap.

But to be eligible for the first instalment, people must have been entitled to their benefits payments by 25 May. The Department for Work and Pensions says that 850,000 pensioner households are failing to claim Pension Credit to which they are entitled - which is a gateway to these extra payments.

Those on disability benefits will receive £150 in September, which may be on top of the £650 payment, because in many cases they have higher energy use.

Anyone receiving the following benefits will be entitled to the extra £150: Disability Living Allowance, Personal Independence Payment, Attendance Allowance, Scottish Disability Benefits, Armed Forces Independence Payment, Constant Attendance Allowance and War Pension Mobility Supplement.

What extra help will pensioners get for winter fuel bills?

Households that receive the Winter Fuel Payment - which is worth £200-£300 and is paid to nearly all homes with at least one person of pension age - will receive an additional £300 in November or December.

That should cover nearly all pensioners across the UK.

Lower-income pensioners, who claim pension credit, will receive the money in addition to the £650 support for those on benefits which is mentioned above.

So, there is a cumulative effect on some of the support payments being given.

A small group of pensioners with disabilities will receive a total of £1,500 when all the new payments and discounts they are eligible for are added up.

What payments are already being received?

About 80% of households are already receiving a £150 energy rebate, often through their council tax bill.

The mechanics can differ depending on how you pay your council tax, for example, through direct debit and which part of the country you live in.

Some payments have been made to people with fuel vouchers, for example, through the Household Support Fund distributed by councils.

An additional £500m has been added to the fund by the chancellor.

How will the chancellor pay for it?

A windfall tax - which he called a temporary levy - will be imposed on energy companies (not your domestic supplier) which should raise about £5bn over the next year.

Companies that get oil and gas out of the ground are getting much more money for it than they were last year, partly because demand has increased as the world emerges from the pandemic and partly because of supply concerns due to Russia's invasion of Ukraine.

Electricity generation companies may also be taxed more in the future.

The tax will cover some, but not all, of the bill for the Treasury, which means the chancellor will have to dip into other funds.

Will the cost of living still go up?

Prices are already rising at a faster rate than at any time in the last 40 years.

Official forecasters say that the rate is set to accelerate. Prices will not fall next year and beyond, but the rate of increase is expected to slow.

The big unknown is what will happen to energy bills in the next few years. That depends to a great extent on the war in Ukraine, and its wider impact on energy supplies from Russia and how that changes the wholesale prices paid by energy suppliers.

Why is support needed?

The cost of living across the UK has been surging, driven primarily by the rising price of necessities such as gas and electricity, but also food and fuel.

Before he announced his plans, Mr Sunak needed to know the scale of the problem. On Tuesday, it was made crystal clear by the boss of the energy regulator Ofgem.

A typical annual domestic energy bill is estimated to rise to £2,800 in October, Jonathan Brearley told MPs. That is an £800 a year increase, on top of a £700 a year rise which took effect in April.

That is a bigger hit to domestic budgets than had been anticipated by many analysts. For about 19 million of the 23 million households affected in England, Scotland and Wales, the higher cost will reflected in bigger direct debit demands from their supplier. Prepayment meter users will see a sudden jump from October.

Households in Northern Ireland have already faced higher prices, where there is no price cap.

The chancellor said he could not cancel the problem for everyone, but was lifting some of the pressure.