Analysis: Europe is paying record prices for energy. A winter crisis looms

The wholesale cost of natural gas has surged to record highs in the United Kingdom, France, Spain, Germany and Italy. Bills for households and businesses are already soaring, and could go even higher as cold weather sets in and more fuel is needed for electricity generation and heating systems.

"We've seen huge price increases," said Dimitri Vergne, head of the energy team at The European Consumer Organization. "It's worrying ahead of the winter, when gas consumption will necessarily increase."

A complex web of factors is at play. A cold spring depleted natural gas inventories. Rebuilding stocks has been tough, thanks to an unexpected jump in demand as the economy bounces back from Covid-19 and a growing appetite for liquified natural gas (LNG) in China. Russia is also supplying less natural gas to the market than before the pandemic.

Meanwhile, other sources of power have been less readily available, with calm summer weather quieting North Sea wind farms, and countries ditching coal as pressure builds to tackle the climate crisis. Germany is also phasing out nuclear power by 2022.

The deteriorating situation is quickly transforming into a full-blown crisis. Spain has announced emergency measures to cut energy bills, while France plans to make one-time €100 ($117) payments to nearly 6 million lower-income households. In the United Kingdom — where natural gas spikes have already threatened to exacerbate food shortages — Prime Minister Boris Johnson's team is debating the extent to which it should offer state support. A UK price cap for consumers is being maintained, but that's helping to push small British energy companies out of business.

Industries across the region are seeing costs take off. Some British steelmakers have had to suspend operations, according to trade group UK Steel. Norway's Yara (YARIY), a fertilizer company, is cutting production of ammonia in Europe by around 40% because of the record high natural gas price.

"Right now, it's unprofitable to produce ammonia in Europe," said Yara CEO Svein Tore Holsether, noting that it costs $900 to produce a metric ton that sells for just $600. The company will temporarily rely on plants in other parts of the world to supply customers.

Storage tanks of liquified natural gas are seen at an import terminal in southeast England on Sept. 21.

Storage tanks of liquified natural gas are seen at an import terminal in southeast England on Sept. 21.

The fallout could weigh on Europe's economy, while exacerbating fears about inflation at a delicate moment in the pandemic recovery.

"To the extent people are worried about the higher cost of energy, they may be inclined to hold back on spending," said Jessica Hinds, Europe economist at Capital Economics.

What's happening

The leap in natural gas prices can be traced back to a chilly spring. Cold weather through April and the beginning of May forced a drawdown in natural gas stocks during a period when demand typically eases.

"We started this whole process of putting gas away ... six weeks later than we normally would," said Tom Marzec-Manser, a natural gas analyst at market intelligence firm ICIS.

But the problems don't end there. China has also been outbidding Europe for LNG, which is preferred as a cleaner alternative to coal as the country tries to make its economy greener.

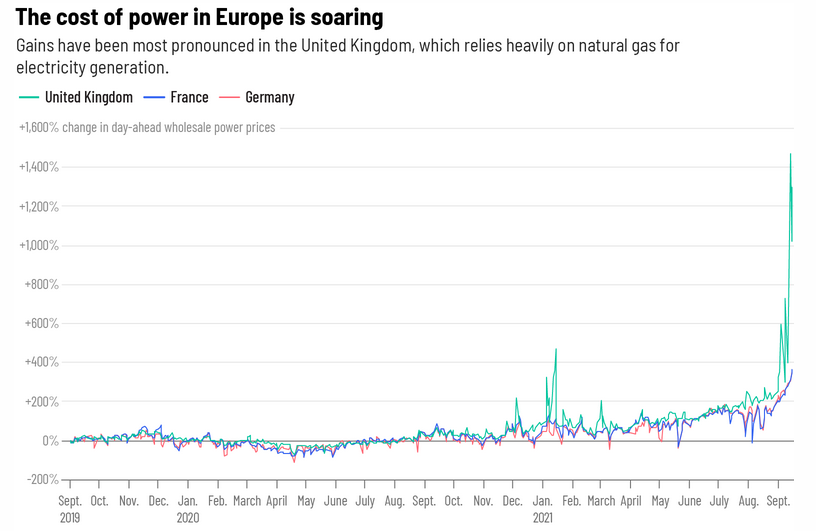

As a result, the price of power for next-day delivery in France jumped 149% between the beginning of August and Sept. 15, according to data from ICIS. In Germany, prices leaped 119%.

And in Britain, which operates a just-in-time market and doesn't have the same storage capacity as continental Europe, costs have surged 298%. Delayed maintenance work, as well as a fire that shut down a power cable that transmits electricity supplies from France, has piled on the pressure.

In this environment, European countries would typically turn to Russia, which meets about a third of the continent's natural gas needs. But supplies from Gazprom, the state-backed natural gas company, have been lower than usual. The International Energy Agency on Tuesday called on the country to open the taps.

"Although Russia is running production at very high levels, there are still fears it can't produce enough to satisfy Europe's very high demand," Wood Mackenzie analyst Graham Freedman said. "There are concerns there may not be enough gas in [Gazprom's] storage to get through the winter."

Marzec-Manser said it's hard to pin down exactly what's happening in Russia. There were some production problems over the summer, and the country is also experiencing higher domestic demand, he said. There are also theories that Moscow is intentionally supplying less than it could to encourage Germany to speed its approvals process for the controversial Nord Stream 2 Pipeline, which will transport natural gas directly from Russia into the European Union.

Norway, which supplies about 20% of the natural gas consumed in Europe, is trying to help fill the gap. Equinor, the state energy company, announced this week that it would increase exports starting in October. But in the near-term, experts warn pressure on prices is unlikely to ease.

Britain most exposed

Political leaders are trying to assuage fears that the public could go without power or heat as the temperature drops.

"We do not expect supply emergencies to occur this winter," Kwasi Kwarteng, the UK business secretary, told Parliament on Monday. "There is absolutely no question ... of the lights going out or people being unable to heat their homes."

But it's increasingly clear that the crisis will be costly, and could weigh on the region's economy while the effects of Covid-19 are still being felt.

The situation is particularly acute in the United Kingdom, where seven small energy providers — including Avro Energy, which supplied about 580,000 customers — have failed in recent weeks because their costs have soared. Dozens more are on the brink.

Other British industries are at risk, too. On Tuesday, the UK government said it had agreed to subsidize a major US fertilizer manufacturer at a cost of several million pounds to taxpayers in order to reopen factories that supply most of the carbon dioxide Britain's food supply chain needs.

CF Industries (CF) decided last week to halt operations at its UK fertilizer plants because soaring natural gas prices had made them unprofitable. CO2 is used to stun animals for slaughter, as well as in packaging to extend the shelf life of fresh, chilled and baked goods.

"I do not see people freezing," said Michael Grubb, a professor of energy and climate change at University College London. "I do see unenviable choices, between a lot of companies going bust and who picks up the tab."

The Confederation of British Industry, a UK business lobby group, emphasized Wednesday that "significant" price rises hit both businesses and consumers.

"It's essential vulnerable customers and key energy intensive companies, which underpin critical UK supply chains, are well supported throughout the winter," Matthew Fell, the chief policy director, said in a statement.

A lot rides on the weather. Henning Gloystein, director of the energy, climate and resources practice at Eurasia Group, thinks that if the next few months yield particularly cold weather, there could be further pressure on certain industries to reduce consumption of natural gas to prioritize supplies to households.

"If it gets cold this winter, [supplies] could get really tight," he said. "Politically, that's really toxic."

Governments will do what they can to shield consumers from rising prices, Gloystein continued, noting that price caps and subsidies are likely to persist. But economists are already revising their inflation expectations for the coming months, cautioning that natural gas shortages will only make price increases triggered by rising demand and ongoing supply chain problems worse.

Prices for CO2 paid by the UK food industry, for example, will go up despite the temporary subsidy to CF Industries. To what extent that gets passed on down the chain to supermarket shelves remains to be seen.

"At the moment, it definitely seems likely we'll be seeing higher inflation in the short term," Hinds of Capital Economics said. "And this is probably going to run into next year."

She predicted that a previous estimate of headline inflation of 3.5% for Europe in the final months of 2021 could rise to 4%.

"Gas prices could push inflation further above [the] 2% [target] for longer," Bank of America analysts said in a recent note to clients.